The Secret Truth You Might Not Know About Dental Insurance

You signed up for Wichita dental insurance! That’s great! It’s been years since you’ve been to the dentist, but now you’re covered. You don’t have to pay anything more when you visit your dentist. Right? Well, not exactly.

Having dental insurance is an important benefit, but many patients find dealing with insurance policies frustrating and confusing. That’s because they must realize how it is designed to understand it. We want to educate the people of Wichita who visit Dr. Eric Farmer so they are not surprised at how much they end up paying.

What Dental Insurance is… and is not

First, let’s talk about what you assume dental insurance is… just like car or house insurance, it should protect you from financial loss. But that’s not how it works. Since most dental services are predictable, like regular visits for cleaning and preventative maintenance, it works more like in-store credit or coupons. It’s simply a way to offset the cost of dental services. Insurance companies expect you to care for your oral health to prevent emergencies and unexpected procedures.

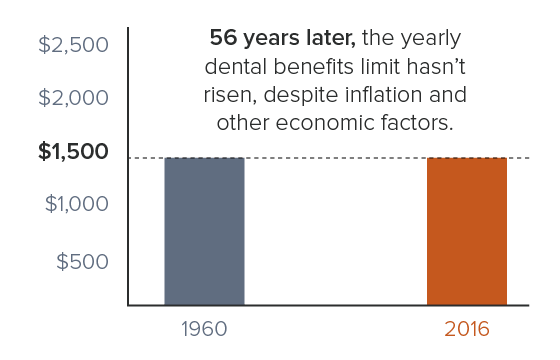

Dental insurance generally comes with a yearly benefit amount that ranges from $1000-1500 per year. That limit is not the amount of dental care you receive but the limit of the amount that the insurance pays. It does not include the deductible that you must pay for first. For example, if you have a $100 claim and the insurance company pays $80 then you used $80 towards the yearly limit. Dental insurance hit the marketplace in the 1960’s and guess what the yearly limits were? Yup, $1500. That went a long way back then. Now it does not take very much to get to that limit.

What’s covered… and what’s not

Benefits can vary widely. An insurance policy will stipulate the procedures they cover and ones they do not. Examine your policy closely to determine your exact coverage. Here are some typical procedures and reimbursement percentages:

- Basic procedures – like fillings and extractions, may be reimbursed at a lower percentage (typically 70%)

- Extensive services – like crowns or bridges, may also be in your policy but there may be a waiting period before they are covered. Other more expensive but beneficial treatments may be excluded, such as implants over bridges.

- Advanced procedures – such as cosmetic or elective procedures are not covered at all.

At the end of the day when you are dealing with your dental insurance policy, you must come to grips with the way dental insurance is set up. It’s there to help you with the costs but not to cover all of it.

How much will I pay?

One of the ways we operate is to give you treatment plans in advance with costs line itemized. We are very open and upfront about our fees to lessen surprises. You deserve to know.

In some cases, we can send in a predetermination or pre-treatment estimate to your insurance company. You will know in advance exactly what your coverage will be and what your financial contribution will be. However, in the insurance company’s fine print, this is not a guarantee of payment. Sometimes a procedure or claim is denied even after they have predetermined it!

We have financing options to help you take care of your balances for routine and elective things. We want to help you overcome the barriers and get the treatment you need and deserve.

Our Priority is Your Dental Health

Our Priority is Your Dental Health

On a daily basis, we have patients who tell us that they only want what the insurance will cover. In many of these cases, that may not be what the patients intend to say. What people really want, up front, is cost certainty. But if that is what they intend to communicate, then they are telling us they want their insurance policy to dictate their treatment rather than their condition. This is NOT the ideal way to achieve dental health.

We understand your financial limitations, and we will do our best to help you get the most from your insurance coverage. But as caretakers of your overall well-being and oral health, we cannot in good conscience allow an insurance company dictate your treatment.

If you have any additional questions, please call Tammie or Jerissa at (316) 722-1110 or request an appointment. We can help you understand your insurance policy, get the most out of it, and ensure your smile will last a lifetime!